3-Year Unified Support Agreements Are a Terrible Idea – Here’s Why.

Picture this: It’s 2 AM, and your company’s mission-critical Windows Server infrastructure is down. Revenue is bleeding at $50,000 per hour. Your team frantically opens a high severity support ticket, expecting immediate assistance from Microsoft’s Unified Support. Instead, you’re greeted by an offshore technician reading from a script, asking you to restart services you’ve already restarted three times. The escalation process drags on for hours while your business hemorrhages money and your reputation takes a beating.

This nightmare scenario plays out regularly for enterprises trapped in Microsoft’s 3-year Unified Support agreements. Despite Microsoft’s aggressive marketing push positioning these extended contracts as strategic investments in stability and cost predictability, the reality is far more sinister.

Microsoft is doubling down on its push for 3-year Unified Support agreements, using sophisticated sales tactics that promise simplified procurement, budget predictability, and enterprise-grade service levels. Sales teams present compelling spreadsheets showing apparent cost savings, streamlined vendor management, and protection against future price increases. But beneath this polished presentation lies a trap that has ensnared countless organizations into overpriced, underperforming support models just as superior alternatives emerge in the marketplace.

3 Year Microsoft Support Cost Comparison

| Support Option | Annual Support Cost (Est.) | 3-Year Total Cost | Price Protection | SLAs | Flexibility |

|---|---|---|---|---|---|

| 1-Year Unified | $1M | $3M | No | Slower, offshore | High |

| 3-Year Unified | $1.3M avg (due to 10% annual increases) | $4.3M+ | No | Slower, offshore | Low (locked-in) |

| 3-Year US Cloud | $700k | $2.1M | Yes | 4-min avg response, U.S. based | High |

For enterprises looking to optimize IT budgets, improve support quality, and retain critical procurement flexibility, these long-term contracts represent a strategic misstep with lasting consequences. This article exposes why 3-year Unified Support agreements consistently become financial burdens and outlines a smarter, more agile path forward that successful organizations are increasingly adopting.

3-year Unified agreements have become sophisticated vendor lock-in mechanisms that sacrifice enterprise flexibility, inflate costs, and deliver subpar service quality precisely when organizations need support most. — Matt Harris, CEO, US Cloud

The Illusion of Price Protection: When "Locked-In" Rates Aren't Actually Locked

One of Microsoft’s most persuasive selling points for 3-year contracts is the promise of rate stability in an era of unpredictable IT costs. Sales representatives confidently assure procurement teams that signing a long-term agreement will shield them from future price increases and provide the budget predictability that CFOs demand. This narrative is so compelling that many enterprises sign on the dotted line believing they’ve secured a smart hedge against inflation and market volatility.

The harsh reality reveals a different story entirely. Most Unified Support agreements contain carefully worded clauses that preserve Microsoft’s right to implement annual price increases throughout the contract term. There is no formal price protection in these agreements—only the illusion of it. Microsoft retains complete pricing power while enterprises surrender their ability to respond to market changes or negotiate better terms.

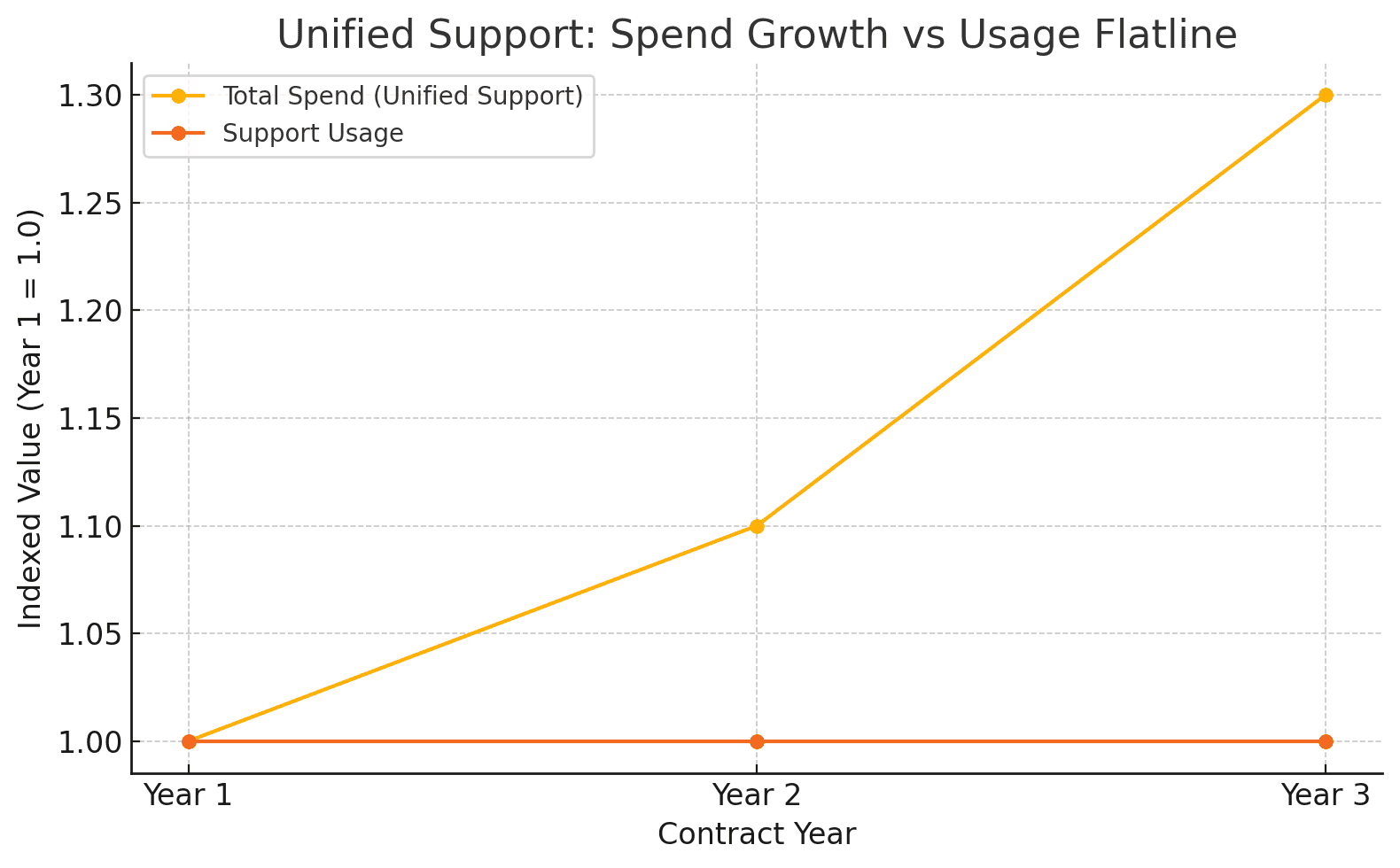

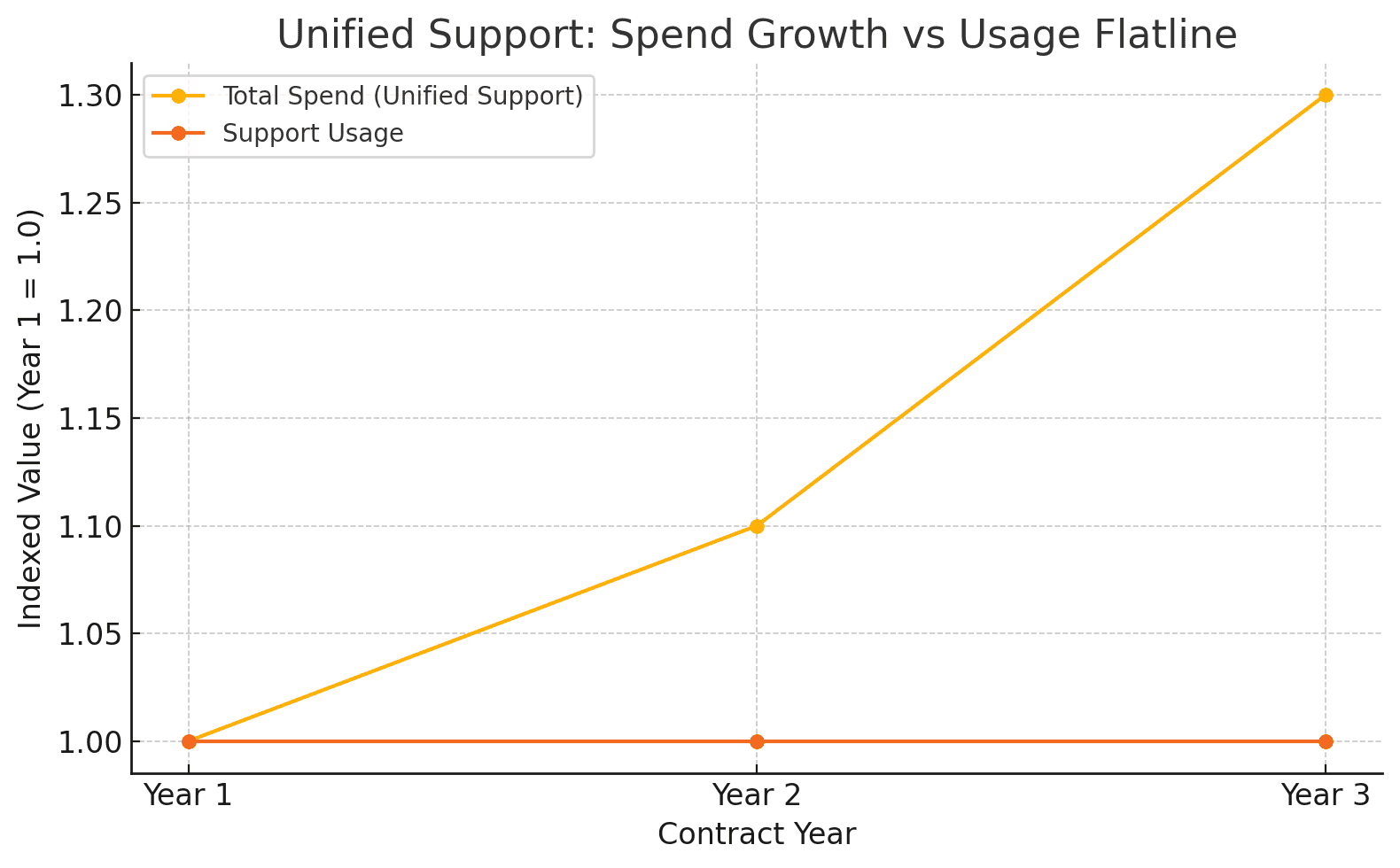

Industry data from leading Microsoft consultancies reveals that clients routinely experience 10-15% annual increases during their 3-year terms, completely undermining the original value proposition. These increases occur despite enterprises maintaining consistent ticket volumes and receiving identical service levels. The price escalation mechanism is particularly insidious because Unified Support costs are calculated as a percentage of total Microsoft cloud and license spend, creating a compounding effect as organizations naturally expand their Azure and Microsoft 365 usage.

Consider a mid-market enterprise spending $10 million annually on Microsoft services. Their initial Unified Support cost of $1 million in year one could balloon to $1.3 million by year three—a 30% increase that occurs automatically through contractual mechanisms, not improved service delivery. This represents $300,000 in unexpected costs that could have funded additional infrastructure, personnel, or competing solutions.

The mathematical reality becomes even more troubling when factoring in natural business growth. As companies scale their cloud workloads, adopt new Microsoft services, or expand their user base, their support costs increase proportionally—regardless of whether they actually require more support. This creates a perverse incentive structure where business success directly correlates with support cost inflation, penalizing organizations for growth and innovation.

The Azure Consumption Trap: Locked In While Costs Spiral

Unified Support’s percentage-based pricing model creates a uniquely problematic scenario that becomes more expensive as organizations succeed with cloud adoption. Unlike traditional support models that tie costs to actual service consumption—such as ticket volume, response time requirements, or dedicated resources—Microsoft’s approach links support expenses directly to total technology spending across their entire ecosystem.

This architectural flaw in the pricing model means that every Azure virtual machine deployed, every Power Platform application developed, and every Microsoft 365 license added automatically inflates the support bill. Organizations find themselves in the bizarre position of paying higher support costs not because they need more support, but because they’re successfully leveraging Microsoft’s technology stack to drive business value.

The lock-in effect becomes particularly painful during periods of rapid digital transformation. Companies pursuing cloud-first strategies, implementing AI initiatives, or scaling their remote workforce capabilities watch their support costs climb in lockstep with their technology adoption—regardless of their actual support needs.

A manufacturing company migrating legacy applications to Azure might see their support costs double simply due to increased cloud consumption, even if their actual support ticket volume remains constant. — Chad Rust, Managing Partner, Parex Technology

More troubling still is the lack of exit flexibility when business circumstances change. Enterprises that overestimate their Microsoft usage, consolidate redundant systems, or strategically reduce their dependence on Microsoft products discover that their support costs remain anchored to historical high-water marks. The contract structure provides no mechanism for downward adjustment, creating a financial commitment that persists regardless of changing business realities.

Third-party alternatives have recognized this structural flaw and designed more rational pricing models. Leading providers offer support that scales with actual ticket volume, defined service hours, or dedicated resource allocation—creating proper alignment between usage and cost. This approach allows organizations to optimize their support spending based on real needs rather than arbitrary technology consumption metrics.

Negotiation Power Evaporates for 36 Critical Months

The strategic implications of 3-year Unified Support agreements extend far beyond support costs themselves, fundamentally altering the power dynamic between enterprises and Microsoft across all technology negotiations. Once an organization commits to a long-term support contract, Microsoft’s incentive to provide competitive pricing, favorable terms, or innovative service options effectively disappears for the entire contract duration.

This negotiation disadvantage manifests across multiple dimensions of the Microsoft relationship. Licensing discussions become one-sided affairs where Microsoft holds all the leverage. Azure consumption negotiations lose their competitive edge because Microsoft knows the customer is already locked into the broader ecosystem. Emerging technologies like Copilot AI, Dynamics 365, or Power Platform can be priced aggressively because Microsoft faces no meaningful threat of customer defection.

The bundling trap represents perhaps the most sophisticated aspect of Microsoft’s strategy. Sales teams frequently present “coterminous contracts” that combine Unified Support with Enterprise Agreements, positioning this bundling as an efficiency gain that simplifies vendor management and procurement processes. Procurement teams, already overwhelmed by complex technology decisions, often embrace this apparent simplification without fully understanding its strategic implications.

However, bundling support with licensing creates a massive single point of vendor dependency that shifts enormous leverage to Microsoft. Procurement teams lose visibility into individual cost components, making it impossible to benchmark support costs against alternatives or negotiate specific service improvements. Microsoft can obscure support cost increases within broader EA adjustments, making it difficult for enterprises to track the true cost of their support investment over time.

By maintaining separation between support and licensing agreements, organizations preserve critical optionality. Annual support renewals create regular opportunities to reassess vendor performance, benchmark against alternatives, and negotiate improved terms based on evolving business needs. This flexibility becomes particularly valuable as the support landscape continues to evolve and new providers enter the market with innovative service models.

Service Quality Stagnation: Why Longer Terms Don't Deliver Better Results

Perhaps the most damaging myth surrounding 3-year Unified Support agreements is the assumption that longer commitments translate into better service quality. This belief stems from traditional vendor relationship models where long-term partnerships theoretically incentivized providers to invest in customer success. However, Microsoft’s support delivery model operates under fundamentally different dynamics that make contract length irrelevant to service outcomes.

Microsoft’s Unified Support infrastructure relies heavily on offshore Tier 1 engineers who follow rigid scripting protocols and have limited authority to resolve complex issues. These front-line responders typically lack the deep technical expertise required for sophisticated Microsoft environments, resulting in lengthy escalation chains that delay resolution of critical problems. Whether an organization has a one-year or three-year contract has no bearing on the qualifications of these initial support contacts or the efficiency of the internal escalation process.

Real-world performance data from trailing 12-month Unified support reports reveal the stark reality of Microsoft’s support delivery. Organizations regularly report waiting weeks for resolution of low and middle severity issues that should be fixed within days.

A recent 2025 analysis by US Cloud of Fortune 500 companies using Unified Support found that over 22% of critical issues required multiple escalations before reaching an engineer with appropriate expertise, and over 18% of high severity tickets exceeded their published SLA targets. – Robert E. LaMear IV, Founder, US Cloud

The fundamental problem lies in Microsoft’s support delivery philosophy, which prioritizes cost reduction over service quality. Offshore support centers operate under strict cost constraints that limit the technical depth and problem-solving authority of front-line staff. Complex issues that require deep Microsoft product knowledge, custom configuration expertise, or architectural guidance inevitably get trapped in escalation queues where they compete for attention from a limited pool of senior engineers.

Contrast this with emerging third-party providers who have built their entire value proposition around superior service delivery. Leading alternatives offer 4-minute initial response times with SLAs from senior engineers averaging 14+ years of Microsoft ecosystem experience. These providers staff their support teams with professionals who previously held advanced roles at Microsoft or major Microsoft partners, bringing both product expertise and real-world implementation experience to every interaction.

The service quality differential becomes particularly pronounced during crisis situations when enterprises need immediate expert assistance. While Microsoft’s support structure forces critical issues through multiple escalation layers, specialized third-party providers can connect organizations directly with the level of expertise required to resolve complex problems quickly and definitively.

The Innovation Opportunity Cost: Missing the Support Evolution

The technology support landscape is experiencing its most significant transformation in decades, driven by artificial intelligence, cloud-native architectures, and evolving enterprise expectations around service delivery. Organizations locked into 3-year agreements with Microsoft are essentially betting that the support model they select today will remain optimal throughout the entire contract term—a risky assumption in such a rapidly evolving environment.

Third-party Microsoft support providers have emerged as legitimate alternatives that often deliver superior service quality at significantly lower costs. Gartner-recognized leaders in this space offer cost savings up to 60% compared to Microsoft’s Unified Support while providing demonstrably better response times, resolution rates, and customer satisfaction scores. These providers have built their businesses around addressing the specific shortcomings of Microsoft’s native support model.

The innovation happening in third-party support extends beyond cost and service quality to include entirely new support paradigms. AI-powered ticket routing, predictive issue identification, and automated resolution capabilities are becoming standard features that dramatically improve the support experience. Some providers offer hybrid models that combine automated intelligence with human expertise, creating support experiences that are both faster and more personalized than traditional approaches.

Organizations locked into 3-year Microsoft agreements cannot experiment with these innovative approaches or adapt their support strategy based on evolving needs. They miss opportunities to pilot new providers, benchmark performance against alternatives, or implement hybrid support models that might better serve their specific requirements. In a business environment where agility and adaptability are competitive advantages, this inflexibility represents a significant strategic handicap.

Operational Security: Long Term Agreements Diminish Emerging Threat Agility

While transparency and sovereignty over support personnel are crucial, three-year Unified Support contracts can dangerously undermine an organization’s agility to respond to emerging threats. In exchange for convenience and pricing incentives, organizations find themselves locked into rigid, globalized support delivery models—often with minimal recourse if vendors change staffing strategies, offload services to offshore engineers, or weaken prior assurances about personnel vetting.

Now, more than ever, it is critical to know who is handling your support and may have access to your tenants or system logs. The recent news that Microsoft has been using Chinese engineers to support US government entities has shocked the public and private sector. Securing your IT supply chain should include contractual guarantees about sovereign support personnel.

Foreign engineers — from any country, including of course China — should NEVER be allowed to maintain or access DoD systems. — Pete Hegseth, Defense Secretary

If a threat emerges—whether it’s a geopolitical shift, a new vulnerability, or a revelation about foreign access to critical systems—long-term contracts mean you’re unable to swiftly demand changes, enforce new security controls, or exit the agreement without major penalties. This loss of flexibility is not just an administrative burden; it fundamentally hampers your incident response, risk management, and ability to maintain the highest standards of operational security. In today’s high-stakes environment, agility—not vendor lock-in—is what keeps your data and your organization safe.

Career and Reputation Risks: When Support Decisions Backfire

The professional implications of support contract decisions often receive insufficient attention during the procurement process, but they can have lasting impacts on IT leadership careers and organizational credibility. When a 3-year Unified Support agreement delivers poor value or creates operational constraints, the executives who championed the decision face internal scrutiny and external reputation damage that extends well beyond the immediate financial impact.

Modern enterprise environments demand cost transparency, vendor accountability, and strategic flexibility from IT investments. Executives who lock their organizations into expensive, inflexible support contracts find themselves defending decisions that appear increasingly outdated as better alternatives emerge. Board members and senior leadership teams are becoming more sophisticated about technology procurement and expect IT leaders to demonstrate clear value from major vendor relationships.

The accountability problem intensifies when support failures impact business operations. During critical outages or security incidents, poor support response can result in significant revenue loss, customer dissatisfaction, and competitive disadvantage. When these failures stem from inadequate support contracts that could have been avoided, the responsibility falls squarely on the executives who approved the original agreements.

A documented case from the public sector illustrates these risks starkly. A state agency overpaid $2.4 million over three years due to poor Unified Support contract terms before eventually switching to a third-party provider. The procurement oversight led to internal restructuring, external audits, and lasting damage to the agency’s procurement credibility. The IT director who approved the original contract saw their career trajectory permanently altered by a decision that seemed reasonable at the time but proved financially disastrous.

Smart IT leaders are increasingly recognizing that support contracts represent both financial and career risks that require careful management. They understand that while signing with Microsoft might feel like the safe, conventional choice, the rapid evolution of the support landscape makes long-term commitments potentially dangerous from both business and professional perspectives.

Breaking Free: Why Flexibility Beats Microsoft’s 3-Year Support Lock-In Every Time

Microsoft’s 3-year Unified Support agreements represent sophisticated vendor lock-in mechanisms engineered primarily for Microsoft’s financial benefit rather than enterprise operational success. The combination of illusory price protection, consumption-based cost escalation, reduced negotiation leverage, and stagnant service quality creates a perfect storm of organizational disadvantage that persists for the entire contract duration.

The rapidly evolving support landscape makes these long-term commitments particularly dangerous strategic decisions. As artificial intelligence transforms support delivery, third-party providers innovate with outcome-based pricing models, and enterprises demand greater vendor accountability, organizations locked into inflexible Microsoft agreements find themselves unable to adapt to changing market conditions or take advantage of superior alternatives.

Smart enterprises are rejecting Microsoft’s bundling strategies and long-term commitment pressures in favor of more agile approaches. They maintain independence between their Enterprise Agreements and support contracts, conduct regular competitive benchmarking, and prioritize SLA-backed performance over vendor loyalty. These organizations understand that in a cloud-first world, support must be transparent, accountable, and aligned with business value rather than vendor consumption metrics.

The professional and organizational risks of poor support decisions have never been higher. IT leaders who lock their organizations into expensive, inflexible contracts face career consequences when those decisions inevitably backfire. The stakes are too high, and the alternatives too compelling, to accept Microsoft’s self-serving contract terms without thorough evaluation.

Before signing any long-term support agreement, conduct comprehensive due diligence. Benchmark Microsoft’s pricing and service levels against third-party alternatives. Pilot innovative providers that offer superior value propositions. Audit your current support utilization to understand actual needs versus projected consumption. Most importantly, preserve your organization’s flexibility to adapt its support strategy as business needs and market conditions evolve.

When the next support crisis strikes—and it will—make sure it’s not your career on the line because you chose vendor convenience over strategic flexibility. The future belongs to organizations that maintain control over their support destiny rather than surrendering it to vendor lock-in agreements that prioritize Microsoft’s financial interests over enterprise success.