EU Financial Services Firm Saves 21 Million Euros – Replaces Microsoft Unified Support with US Cloud.

- EU Financial Firm Saves €21M - Replaces Microsoft Unified Support

- Offsetting Microsoft Software Price Increases

- Year 2 of Microsoft Unified Support - No Discounts Offered

- Key Decision Drivers - US Cloud Microsoft Support

- Improved Support Quality - No Offshoring to India

- Microsoft Vendor Management – Europe Union (EU)

EU Financial Firm Saves €21M - Replaces Microsoft Unified Support

The Global 2000 European Union (EU) investment firm has replaced Microsoft Unified Enterprise Support with US Cloud. The financial services giant is moving from Microsoft Unified to US Cloud for a 52% cost reduction in 2023 and millions in support savings through 2028.

Key aspects that weighed into the change from Microsoft to the largest third-party Microsoft support provider in the world were offsetting their software price increases, improving support quality, and providing GDPR compliance.

Audience: Europe Financial & Banking | EU IT Sourcing and Procurement | EU Software Asset Management (SAM)

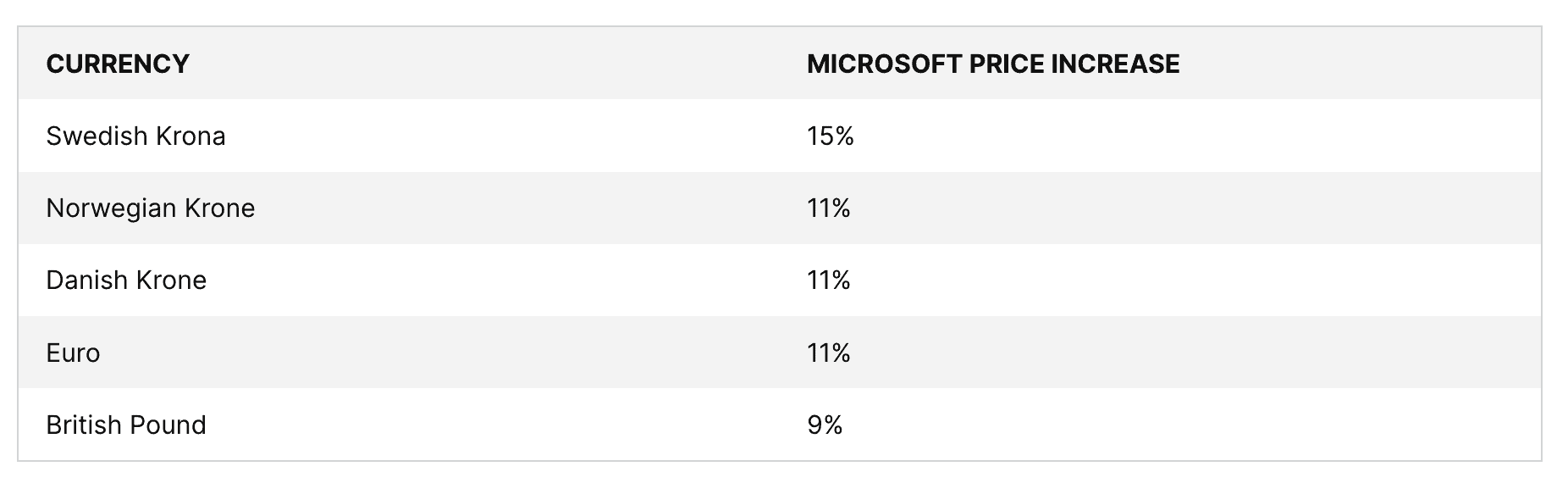

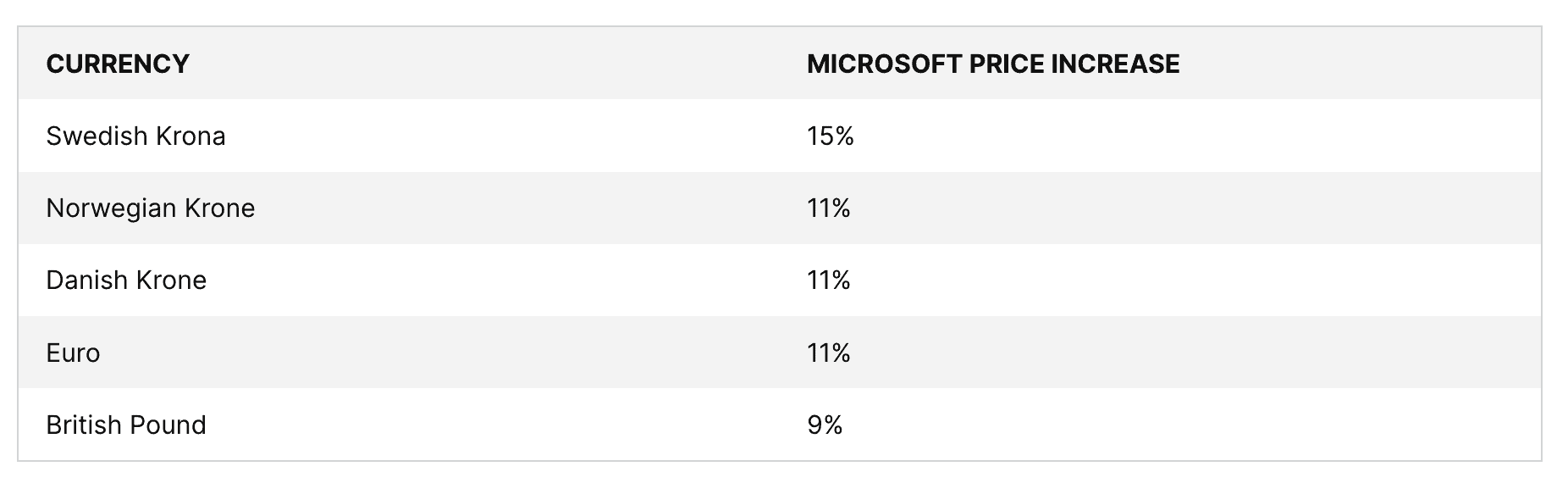

Offsetting Microsoft Software Price Increases

Microsoft announced a 9-15% price increase for all Cloud services in Europe and the United Kingdom starting April 1, 2023. To counteract this, multinational, UK, and EU enterprises are utilizing US Cloud’s 30-50% savings on all Microsoft Unified Support.

Additional details include:

- Perpetual licenses will not be affected, such as Windows Servers, Exchange Servers, Office Professional Plus, and Windows Interprise 11 on-premises.

- Customer with a running agreement that includes price protection (such as the Enterprise Agreement, Open Value Subscription – Company Wide) benefit from the price protection for previously ordered products. Those products will not receive the new, higher price under that Agreement.

- Customers with a Microsoft Customer Agreement (seat-based offers such as Office 365, Microsoft 365, Dynamics 365) do have price protection during the term of their subscription. Only when they renew their subscription after April 1st or when they start a new subscription after April 1st will they receive the cost increase.

- Azure Plan through Microsoft Customer Agreement is already priced in the US Dollar at a higher monthly price and won’t be affected.

- Price adjustments apply to commercial, governmental, and educational customers.

Year 2 of Microsoft Unified Support - No Discounts Offered

As the global demand for Cloud services slows, analysts are reporting less discounts being offered by Microsoft for Premier or Unified support services.

Year 2 of their Microsoft Unified Enterprise Support resulted in the removal of the 25% Transition Adjustment discount and 27% Software Assurance Benefit (SAB) credit.

A cost avoidance analysis of years 2023-2028 highlighted additional increases of 259% over the next 4 years when overlaying the financial firm’s Microsoft roadmap with its associated Unified costs.

The financial services enterprise recouped €4 million Euros (EUR) in year 1 and an additional €17 million Euros (EUR) over the next four years allowing them to invest in strategic IT initiatives driving competitive advantage and growth.

Key Decision Drivers - US Cloud Microsoft Support

US Cloud support services are:

- Reducing the cost of MS Unified Support by 52% in the first year

- Recommended by EU Software Asset Management

- Proven to capably support large enterprises

- 24/7/365 global support with 15-minute response SLA

An analyst in London recommended US Cloud to the financial services firm as a means of offsetting the recent Microsoft Cloud services price increase. The enterprise was able to rapidly verify GDPR compliance and multi-national coverage. The firm elected to participate in the Proof-of-Concept program to further validate service capabilities and found US Cloud able to sufficiently support their organization across both its Microsoft Cloud and on-premises technologies.

“The cost avoidance will allow us to fund our new mobile platform scheduled for release in Q3 2023.”

— Phillipe I, Office of the CTO, Global 2000 EU Investment Firm

Improved Support Quality - No Offshoring to India

It’s the first time we’ve seen a European client report that the CSAM contract explicitly calls out Microsoft Affiliate service delivery in India. This results in a significant gross profit increase for Microsoft. With a big portion of Unified Support outsourced already, it makes sense for the account management to follow. Unfortunately, this is resulting in a big dip in EU enterprise satisfaction with the Microsoft Unified Support experience.

- Moving from Technical Account Managers (TAM) to Customer Success Account Manager (CSAM) cuts the average EU salary from €183,000 to €83,000.

- By offshoring the CSAM function to India, Microsoft cuts that cost in half again to an average of €38,000 fully loaded with benefits.

US Cloud predicts this new “total Unified outsourcing model” will become the norm for 2023 and beyond as the “unlimited tickets” Unified load builds and the IT outsourcers embrace Microsoft’s cheaper CSAM account management model.

Microsoft Vendor Management – Europe Union (EU)

EU based financial services firm replaces Microsoft with world’s largest third-party Microsoft Enterprise Support provider to offset Microsoft price increases during turbulent economic conditions.

Client: Large European Union (EU) Investment Firm

Industry: Wealth Management

Annual Revenue: €14 B

Key Drivers: Cost reduction, cost avoidance, support quality

Client Profile: A European (EU) multinational investment bank with over 11,000 employees that had migrated a majority of key Microsoft systems to the cloud.

Why Leave Microsoft Unified: This sophisticated EU wealth management firm was renewing Unified Support and could no longer absorb the skyrocketing costs. Traditionally the Client’s high-caliber internal IT staff solved the majority of Microsoft break-fix tickets. Only ultra-complex issues or ones that required code or tenant access were submitted to Microsoft Unified Support. With the “all-or-nothing” pricing of Unified Support, the Client preferred the traditional Premier Support approach of buying just the support hours they needed. As Unified discounts were removed at renewal, the enterprise made the decision to seek out an alternative to Microsoft. A UK based Software Asset Management community analyst member identified US Cloud as a viable competitor to MS Unified.

Switching to US Cloud: After RFP (instant download) submission, the client found US Cloud as the only alternative with full feature parity and capability to replace Microsoft Unified Enterprise Support.

Europe EU Financial Case Study – US Cloud Microsoft Support Services

Budget Dollars Saved

Year 1: €4,400,000

Cost Reduction

Year 1: 52%

Cost Avoidance

Years 2-5: 259%