Microsoft Azure Negotiation Strategy – Large Deals.

Microsoft Negotiation Strategy for Large Azure Deals

Large Azure buys require adept Microsoft negotiation strategy. Avoid common pitfalls while combining Azure discounts to reduce your MS spend.

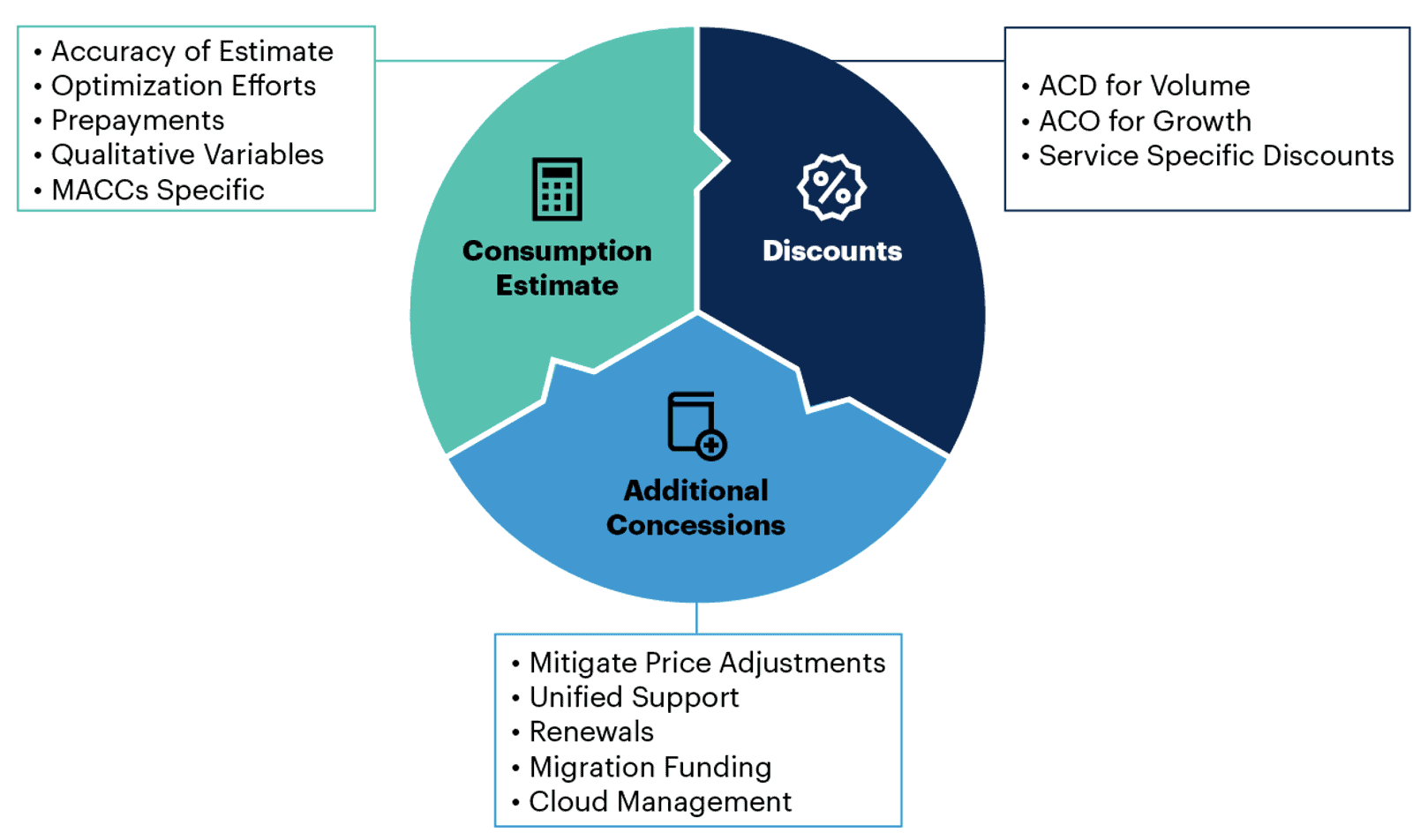

To optimize the terms and conditions of their growing Azure contracts, enterprise IT sourcing, procurement and vendor management teams must carefully negotiate consumption estimates, discounting and concessions.

Large Azure Deal Landscape

Microsoft enterprise customers renewing large Azure deals may lose leverage and waste IT budget if they fail to prepare:

1) to estimate consumption

2) understand the finer details of their Azure deal

As enterprises renew their rapidly growing Azure contracts, most are finding their discounts have disappeared. In order to regain prior discount levels, appropriate negotiation strategies must be applied.

Enterprise sourcing and procurement teams need to calculate the total cost of their large Azure deal to include costs of any migrations, support, training, and price step ups in multi-year agreements.

Recommended Azure Negotiation Strategy

Enterprises can increase Azure negotiating leverage with Microsoft by accurately estimating their Azure consumption – both quantitative and qualitative.

Look closely at consumption estimates to make sure optimization efforts are realistic. Use a Microsoft Azure Consumption Commitment (MACC) amendment toavoid wasting unused prepayments.

Pursue all possible discounts to optimize Azure value, growth and workloads Concessionsinclude Azure consumption discount (ACD), Azure credit offer (ACO) and service-specific discounts.

Ask Microsoft for additional Azure incentives to mitigate: price increases, Unified enterprise support, renewals,migration funding and support for your enterprise’s cloud initiative.

Enterprise Azure Planning Assumptions Thru 2026

Cloud infrastructure and platform services (CIPS) customers seeking advanced concessions on cloud deals willachieve 15% of savings on their spend.

75% of organizations will double their savings by leveraging FinOps rather than securing a commitment discountwithin MACCs.

20% of enterprises will use third-party support to cut their Microsoft Unified Support costs by 50% in order to offset Azure TCO.

How Microsoft Sells Large Azure Deals

Azure is Microsoft’s primary sales priority, and it is common for enterprises to include sizable Azure buys in their overallMicrosoft deal negotiations including Enterprise Agreement (EA) renewals.

For those enterprises looking to gain leverage, Azure buyers may prepay for overestimated consumption and later forfeit those prepayments for unused commitments. Azure buyers beware, underestimating could reduce leverageduring negotiations. Enterprise clients must understand all Azure options to gain the greatest discounts and avoidhidden costs.

Microsoft’s main Azure negotiation vehicle is through the Microsoft Azure Consumption Commitment (MACC) amendment. The MACC is usually signed for a three- or five-year term (plus an additional one year grace term), andhas no minimum commitment. However, enterprises have indicated during negotiations that Microsoft requires aminimum Azure contract value of $1 million a year. Enterprises spending less than $1M per year on Azure are moved to the lower tier Microsoft Customer Agreement (MCA).

Along with volume commitments to obtain leverage, clients will be able to use other negotiation variables, such as thetypes of migrations, competition, publicity amendments, third-party support, or duration of deals.

Before starting the Azure negotiation process with Microsoft, enterprise sourcing and procurement teams should know and analyze all possible deal options to improve their leverage and pricing. During the MACC negotiation with Microsoft, it is critical to have accurate Azure consumption estimates as well as a complete understanding of all Azure direct and indirect costs. Enterprises should seek all discounts and have awareness of lesser known concessions – see image below.

Sourcing and procurement teams should take the proper time to reduce and optimize their enterprise’s Azure spend. Volume licensing as well as advanced incentives on mitigation of price adjustments, enterprise support,renewals, migration funding and support for cloud initiatives are available with enough lead time and preparation.

Accurate Azure Consumption Estimation is Key

Before engaging with Microsoft, you will need to accurately estimate your Azure consumption.

This is the foundation of your Azure negotiation with Microsoft. Enterprises should not overcommit to an Azure buy they will not be able to consume. Nor should sourcing and procurement teams under commit when they could have usedthe additional valuable leverage.

Enterprises must take advantage of what makes their Azure consumption unique by understanding the variables that can ultimately lower the cost of your large Azure deal.

Azure Consumption Forecasting Must be Realistic

Forecasting Azure cloud consumption over the next 3 to 5 years is difficult.

During the presales phase, Microsoftand/or third-party cloud architects are often hired to assist enterprises with estimating Azure costs. Often thesepresales estimates result in much higher projected cloud consumption than anticipated, but sometimes theyconversely provide aggressively low numbers to compete against Amazon Web Services (AWS) and Google Cloud Platform (GCP) offers.

These unrealistically low estimates do not reflect the costs of a full production implementation. It can be difficult toproject actual Azure consumption in the first and second years of usage. The large variance with these proposals isdue to assumptions that were built into the estimate that may not be reflective of your initial years. Having acomplex migration, evolving requirements and building up cloud maturity are examples where Azure consumption forecasting is a difficult exercise.

Optimize Your Azure Consumption Estimate

The lowest Azure consumption estimate done by enterprise sourcing and procurement teams assumes the full use of three-year Reserved Instances (RIs), Savings Plans and all Azure Hybrid Benefits (Microsoft’s bring your own license program on Azure).

The combination of these mechanisms can decrease costs by 50%. However, these savings vary based on the RIs, Savings Plans and bring your own license (BYOL) ratios and rules, whichdiffer between Azure multitenant and Azure dedicated hosts.

Most enterprises don’t start off with RIs because they want to ensure that they have identified a steady-stateworkload before committing. Azure cloud buyers may not have Hybrid Benefits for all the licenses they will be using inAzure, especially if they are running unlimited VMs on-premises, as this does not translate to the Azure multitenantenvironment. Make sure to include those optimization efforts in your forecast to counter Microsoft’s strategy to forceyou make larger commitments.

MACC latter years of optimization efforts are equally important as migrations have been completed. Before committing to a MACC renewal, sourcing and procurement teams should work closely with enterprise IT architects or specializedthird parties to fully optimize the post-migration steady-state. These efforts can impact run rates by 20% to 40%, and it’scritical to have a clear understanding of this prior to making Azure renewal commitments.

Avoid Forfeiting Unused Azure Prepayments

Most enterprises negotiating large Azure prepayment deals with Microsoft no longer place Azure as prepaymentsinto their Enterprise Agreement (EA/EAS/SCE).

Doing so requires prepaying at least annually (or for the entire term), so any unused amount is forfeited at the end of the 3 or 5 year term. As a reminder, a MACC does notrequire any amount to be prepaid. Microsoft enterprise customers use the Server and Cloud Enrollment (SCE) orthe MCA direct as the master Azure contract along with the MACC amendment, which allows for the committed sum to be used over the term of the agreement without an annual target.

Enterprises should take a conservative approach to their Azure commitments to avoid wasted IT budget, even ifthey have a 12-month grace period under MACCs. Consider the three- or five-year commitment only when you are fairly certain of consuming all Azure funds before the end of the contract.

Increase Negotiation Leverage – Analyze These Azure Deal Variables

Azure Deal Variable 1: More Workloads. Azure enterprise buyers can make commitments not only based on a certainamount of money to consume, but also based on the migration of high-value core components of their IT to Azure.Enterprises could commit to key projects with Azure as a CIPS preferred platform, which could have a positive impact onthe ACD. This scenario gives Microsoft more predictability over your usage and long-term dependency upon Azure. Itcould also indicate higher confidence in the purchase and use of Azure strategic offerings. Examples of enterprise IT key Azure workloads include:

- ERP migration such as SAP S/4HANA

- HR system migration

- Business-critical databases migrations

- Virtual desktop infrastructure

- Backup as a service/storage as a service

- Microsoft industry clouds (healthcare, financial services, manufacturing, retail)

- Internet of Things (IoT)

Carefully review the language proposed by Microsoft for any workload migrations commitment, including commitment to migrate over a predefined planning period, and validate whether that is achievable.

Azure Deal Variable 2: More Spend. Although your enterprise may have taken a conservative estimate of your Azure spend, do not waste negotiation leverage if there is a high chance that you will exceed that estimate. You could include in your agreement an amendment that will state that a different type of ACD will apply if you hit certain levels of spend. An example would be:

- Baseline ACD is 20% for $90M over three years, equivalent of $30M per year

- If the enterprise reaches $40M at the end of year 1 or year 2, the ACD moves up to 21% going forward

- If the enterprise reaches $50M at the end of year 1 or year 2, the ACD moves up to 22% going forward

You could also combine this mechanism, which will reward you next year, with the ACO model, as described later in this document, to reward you for the past year.

Azure Deal Variable 3: Azure Competitors. Competing CIPS vendors such as Amazon’s AWS or Google’s GCP are strong competitive threats to Microsoft’s Azure. Although Microsoft has increased its feature set for Azure to be morecompetitive with AWS, most enterprises with use multiple cloud providers for different workloads or applications.

Enterprise sourcing and procurement teams should bid all proposed workloads and commitments to multiple cloud providers. Compare CIPS vendors on rates, metrics, how discount is applied and rules about marketplaces in orderto build leverage.

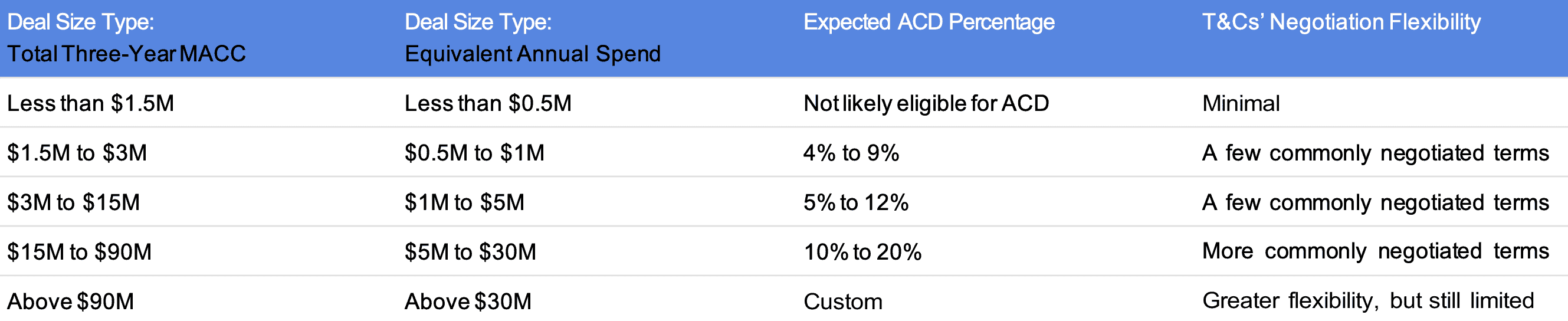

Azure Deal Variable 4: New vs. Renewal. ACD levels that were available five years ago when spending $10 million per year on Azure are now available only to customers with an annual Azure spend of at least $30 million a year. Expect discount ranges to fall further over time with Azure AI uptake. To mitigate this risk, enterprises shouldnegotiate renewal discounts into their contract (see below).

Enterprises at the lower end of Azure spend ($0.5 to $1 million per year) can expect minimal discounts on their Azuredeals. In those negotiations with Microsoft, sourcing and procurement teams may still want to leverage their “first-time buyer” position to negotiate more significant discounts on their Microsoft Enterprise Agreement contract.

Azure Deal Variable 5: Brand Publicity. To be able to reference your brand, logo or name is valuable to Microsoft. This concession is also valuable to Enterprise IT as it will ultimately create some distractions during the course of the agreement. You do not need to have a worldwide-known brand to gain Microsoft’s interest. You could be visible in a specific industry such as Azure Industry Cloud offerings, that Microsoft needs to market to. Keep in mind that your enterprise’s CISO may want inclusion in the decision process due to security risks of making your CIPS vendor public.

Azure Deal Variable 6: Five-Year Azure Deals. Although getting a five-year term under the EA (instead of thestandard three-year term) for an M365 E5 deal is considered a concession from Microsoft, it is entirely different for anAzure Consumption Commitment. Microsoft places a premium on five-year Azure deals because:

- A bigger overall commitment (a $3 million, three-year MACC becomes a $5 million five-year MACC, not a $3million five-year MACC), means more revenue recognition for the sales team at signature

- A longer period keeps competitors like AWS or GCP at bay

- A longer period of time for Microsoft to engage with you, upsell, and create more dependance

Microsoft will propose MACCs over five years for a bigger ACD, even though the annual commitment may be comparatively similar. Enterprises should carefully assess the impact of a longer commitment – overall financial commitment and a longer lock-in term.

Azure Deal Variable 7: No Commitment With Discounts. In some cases Microsoft will offer “no financialcommitment” deals to early adopters (of certain Azure services within an industry or region) that extend discountsbased on an executive promise of migrating Enterprise IT workloads to Azure. These no commitment Azure accountstend to be limited to organizations that are strategic brands or industries and represent a sizable long-term revenue potential.

Analyze the MACC Carefully and Thoroughly

The MACC has many advantages for Azure enterprise buyers, including no upfront payments and billing as you go, but it’s still a large financial investment made with Microsoft, billable at the end of your MACC term.

MACC amendments have specifics you must analyze and understand before signing:

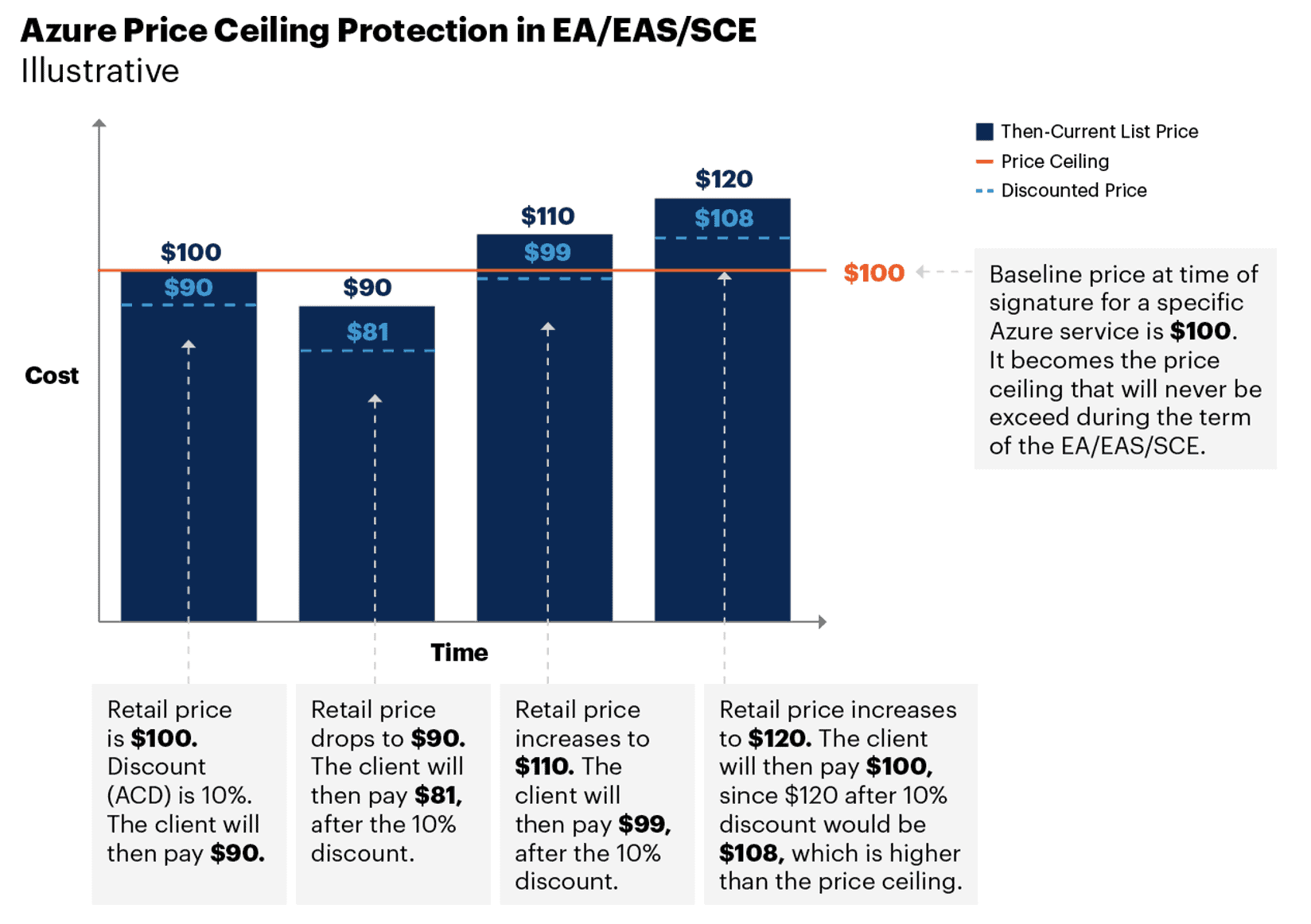

Contracting Vehicle: MACC is available in the EA, EAS, EES, SCE and the Microsoft Customer Agreement(MCA) direct with Microsoft (not under the CSP option). Enterprise sourcing and procurement teams still favor MACCs under EA/EAS/SCE because of the price ceiling protection attribute included in these types of agreements.

What Azure spend counts toward the commitment: This includes all Azure spend (inclusive of discounts) on each monthly invoice, including Azure RIs, Azure Marketplace preferred solutions and any Azure prepayments made.

Difference between Azure commitment and consumption: Your commitment will be the net billed by Microsoft, after the application of discount (if you have one such as described in the Pursue MultipleDiscounts — Combine Based On Your Use Case section). So make sure your Azure estimate takes into account that your enterprise will have to consume a retail value that is higher than your commitment.

Example – a $150 Million MACC commitment, over three years, with a 20% ACD, will mean a consumption, without discount, of $187.5 Million.

Unused Azure Commitments: At the end of the MACC term, any unused Azure commitments will be billed via an Azure prepayment, which enterprises will have up to 12 months to spend (grace period). Your Azure Consumption Discount (ACD) is not applied to this shortfall unless you negotiate a new MACC, with a new ACD that will apply to the shortfall amount.

Note – Marketplace purchases cannot be paid against any shortfall invoice (prepayment). However, you couldpurchase, before the end of the grace period, reservations in order to avoid any loss of this prepayment.

Azure Reservations: Reservations are prepurchased (but not prepaid) Azure services (such as VMs or block blob storage). Microsoft sells Azure reservations at reduced rates but will not apply the ACD on a reservation.Your use of reservations will debit a commitment, but will not be discounted.

Price cap protection: MACC under the EA/EAS/SCE (not under MCA) creates a price ceiling protection. Theprice you pay for Azure services during your MACC term will be the lesser of the then-current list price (minus the discount if you have one) and the retail price at the time of signing the MACC. So if the Azure retail price were to increase, your discount would be applied to the new higher rate, but your rate would cap out at the ceiling you started with at signing.

Combine Multiple Azure Discounts

Assess Azure Commitment Discounts (ACD): Here are the expected discount ranges based on annual Azure spend, but note that there are many variables (ofwhich discounts are only one negotiated concession) that can have an impact on your enterprise’s Azure negotiations with Microsoft. This is an approximate benchmark and is subject to adjustments as program offerings and marketconditions change. Also remember that the ACD does not apply to prediscounted offerings, like Reservations orSaving Plans.

Microsoft will take into account the size of your immediate commitment, but also the potential for Azure consumption growth. The ACD and Microsoft’s negotiation flexibility will also depend on the deal variables listed in the previoussection.

Use Consumption Credits (ACO) and Tiered Discounts as Azure Usage Grows: The most commonly negotiated discount method is based on making a commitment, with a promised consumptionrate over a set term in exchange for a discount percentage for Azure cloud services. However, this does not addressan enterprise’s long-term Azure growth potential. In a tiered discount approach, Microsoft can apply a monetarycredit to the Azure invoice when a migration (consumption) target level has been reached. The more the enterpriseconsumes, the more credits it receives. These additional Azure credits will then be applied to the next invoice.Microsoft will label them as “Azure Commitment/Consumption/Credit Offers” (ACOs) in your proposals. Here areexamples of ACOs you may negotiate with Microsoft.

Service-Specific Azure Discounts: The ACD will be the most common discount applied to Azure cloud services, but enterprises should also look into service-specific discounts. Examples would be:

- Prediscounted services discounts – Prediscounted Azure services, like Reservations, Spots VMs or SavingPlans, are priced “as is,” and will not receive the Azure buyers with annual spends beyond $10M a year should request discounts applied to RIs. Applying the negotiated discount to RIs is a common practicewith Microsoft’s competitors, AWS and GCP. Sourcing and procurement teams should also challengeMicrosoft on discounts on Azure Savings Plans, especially with the retirement of the RI’s exchange option in January 2024 and noted in the 2024 US Cloud Executive Summary.

- Azure sales priorities discounts – Azure sales team priorities include: IoT, Industry Clouds, IoT, AI, analytics andAzure Kubernetes If your enterprise will consume any of these Azue sub-categories you should negotiate a discount that is specific to that service. The discount rate should be higher than the ACD and shouldrange from x2 to x4, in place of the ACD. Build more leverage by comparing those services with the competitor offerings from Amazon AWS and Google GCP.

- Storage and data transfer discounts – These the two of the most common service areas that enterprise Azure buyers will negotiate separate discounts Discounts range from 20% to 60%. Microsoft may require a commitment level for a minimum number of petabytes in these Azure storage and data transfer contracts.

- Highest consumed services discounts – These are similar to the previous type of discounts, but directly attached to your Azure services Enterprises should list your predicted top 10 to 30 services and negotiate from top to bottom. That way, more Azure SKUs are in scope, and newly added SKUs could benefitfrom the concession. Make sure to include the right to revise that list at your EA/EAS/SCE anniversary to align to your actual Azure consumption. The discount here should be higher than the ACD, from a x2 to x4factor (compared to your ACD).

- Price lock protection – Service-specific discounts will be subject to the same rules as the ACD: a discountapplied on the then-current list price of those Azure services (still subject to the price ceiling protection in EA/EAS/SCE if used). In order to create real price protection, negotiate a price that will be locked throughoutthe course of your agreement with Microsoft, similar to the price of M365 subscription in the Customer Price Sheet of your EA.

Azure Deal Acronyms and Glossary

| MACC | Microsoft Azure Consumption Commitment |

| ACD | Azure Consumption Discount |

| ACO | Azure Credit / Consumption / Commitment Offer |

| ECIF | End Customer Investment Funding |

| EA | Enterprise Agreement |

| MCA | Microsoft Customer Agreement |

| CSP | Cloud Solution Provider |

| CCOE | Cloud Center of Excellence |

| RI | Reserved Instance |