Microsoft Software Spending to Increase 14 Percent in 2024.

Microsoft Software Spending to Increase 14% in 2024

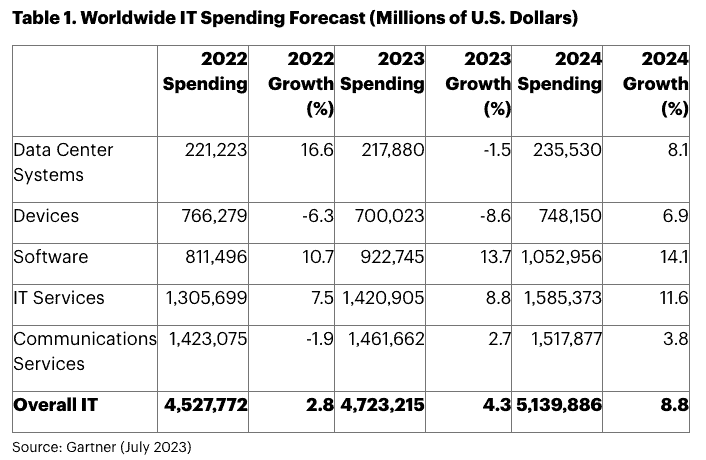

Per Gartner, enterprises worldwide are expected to spend 14% more on Microsoft software in 2024.

Software is the second-highest IT spend category right behind IT services. As a result, sourcing, procurement, and vendor management leaders are analyzing Microsoft software cost-saving opportunities such as third-party Microsoft support to help offset the growing spend.

2024 Worldwide Increase in IT Spending Forecasted

The five major markets of devices, data center systems, software, IT services and communication services are all expected to grow in 2024, according to Gartner data.

Spending on data center systems is expected to grow from $237 billion this year to $260 billion in 2024, up 9.5 percent annually.

The devices market is expected to reach $722 billion in 2024, up 5 percent compared with $689 billion this year.

Worldwide spending on software is projected to increase from $916 billion in 2023 to $1.04 trillion next year, representing an annual increase of nearly 14 percent. Software will see the highest increase of spending next year, Gartner said.

Gartner predicts the largest tech market next year will be around IT services. Global spending on IT services is expected to reach approximately $1.55 trillion in 2024, up more than 10 percent compared with $1.4 trillion in 2023.

The global communications services market is predicted to increase to $1.5 trillion in 2024, up from $1.45 trillion this year, representing modest 3 percent year-over-year growth.

Worldwide spending on software is projected to increase from $916 billion in 2023 to $1.04 trillion next year, representing an annual increase of nearly 14 percent. Software will see the highest increase of spending in 2024.

Generative AI Will Not Impact 2024 IT Spending

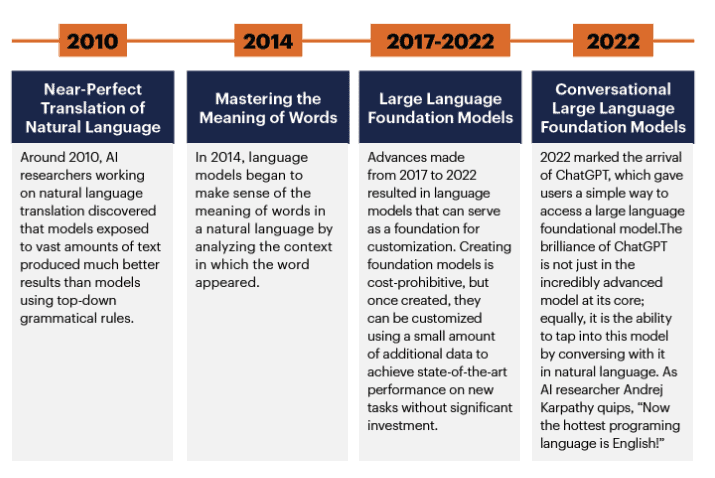

While generative artificial intelligence (AI) is top of mind for many business and IT leaders, it is not yet significantly impacting IT spending levels.

In the longer-term, generative AI will primarily be incorporated into enterprises through existing spending.

Generative AI’s best channel to market is through the software, hardware and services that organizations are already using. Every year, new features are added to tech products and services as add-ons or upgrades. Most enterprises will incorporate generative AI in a slow and controlled manner through upgrades to tools that are already built into IT budgets.

Azure Drives 2024 Microsoft Software Spend Increase

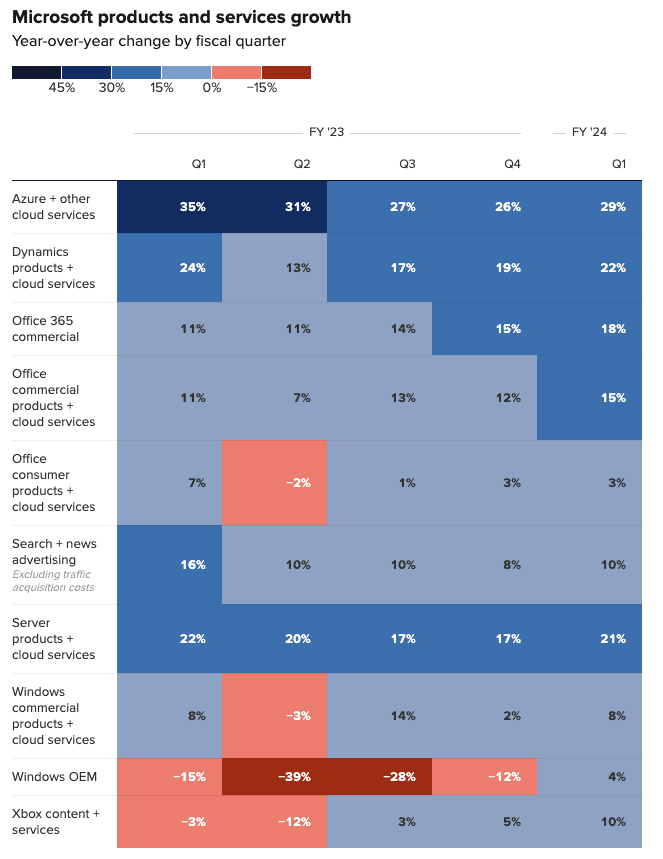

Azure spending has cooled but is still the largest additional Microsoft software spend across all industries and organization sizes.

Microsoft Azure has about 22% of the global Cloud infrastructure market while the leader Amazon, has 32%. Azure spending is forecasted to grow 25-30% in 2024.

Microsoft is “still helping customers use the Microsoft Cloud to get the most value out of their digital spend, and driving operating leverage,” CEO Satya Nadella said in the earnings release. Enterprise clients are still finding ways to save money on cloud spending, a trend multiple large cloud infrastructure providers have flagged in the past few quarters.

Meanwhile, clients are flocking to new generative AI tools in the cloud that are enhanced with software from Microsoft-backed startup OpenAI. The Azure OpenAI Service now has 18,000 customers, up from 11,000 customers in July. Higher capacity for graphics processing units in Azure boosted growth.

More than half (55%) of top technology officers across sectors of the economy say they plan to purchase enterprise-level gen AI software, such as Microsoft Copilot, in the next six months. While another third (32%) said they have not made the spending decision, only 13% said they would not be acquiring similar gen AI capabilities. Source: CNBC Technology Executive Council Survey

Top Azure Trends in 2024 Driving More Microsoft Spend

1. Use of Azure to Power Verticalized Strategies

Businesses in a variety of industries can utilize Azure to enable verticalized strategy. Verticalized strategies entail developing solutions specifically to address the requirements of a given industry or vertical. The scalability and versatility of Azure make it the perfect platform for such tactics.

For instance, Azure can be used in the healthcare sector to handle and store patient data while guaranteeing HIPAA compliance. Telemedicine apps, which have grown in popularity as a result of the COVID-19 epidemic, can also be implemented using Azure.

Banks in the financial sector can utilize Azure to host their essential banking applications, which need to be highly scalable and reliable. Azure can also be used for risk management, fraud detection, and financial analytics.

Azure can be used in the industrial sector to maintain inventory levels, enhance quality control, and monitor and improve supply chain processes. Azure can be utilized for preventative maintenance, which aids producers in identifying and fixing equipment issues before they happen. It may also be utilized for supply chain optimization, customized recommendations, and real-time inventory management.

2. More Use of AI and Machine Learning Powered by Azure

Microsoft’s cloud computing platform Azure provides a variety of AI and machine learning tools and services to assist businesses in resolving challenging issues and coming to more informed decisions.

Developers can include computer vision, speech recognition, natural language processing, and other AI capabilities into their apps using the pre-built APIs and SDKs provided by Azure Cognitive Services.

Azure Databricks, a collaborative cloud-based platform for data engineering, data science, and machine learning, is an additional effective tool. Users can prepare data, create and train models, and expand their deployment using its unified analytics platform.

All things considered, Azure’s AI and machine learning capabilities give businesses the resources they need to turn their data into insightful understandings and make wise decisions.

3. More Azure Internet of Things (IoT) Technology

Internet of Things (IoT) solutions are being developed and managed by enterprises using the entire set of tools and services known as Azure IoT. It makes it possible for companies to link, control, and watch over their IoT devices.

A fully managed SaaS platform called Azure IoT Central makes it easier to create and maintain IoT applications. For various IoT use cases, it offers pre-built templates and workflows.

A service called Azure IoT Edge enables businesses to handle and analyze IoT data locally, cut down on latency, and lower bandwidth costs by extending Azure IoT capabilities to the network’s edge.

4. Intelligent Cloud & Azure Edge

The foundational elements of Microsoft’s Azure cloud computing platform are Intelligent Cloud and Azure Edge. Azure’s cloud-based services and capabilities, including AI and machine learning, data analytics, and application development and deployment, are referred to as the “Intelligent Cloud.” These services are available from any location in the world and are simple to scale up or down.

On the other side, Azure Edge is a collection of services that extend Azure’s capabilities to the network’s edge, giving companies the ability to handle and analyze data locally, nearer the source. Azure Edge services include, among others, Azure IoT Edge, Azure Stack Edge, and servers that support Azure Arc.

5. Cognitive Services from MS Azure

Microsoft Azure Cognitive Services comprises of APIs that are powered by AI and allow developers to add smart features to their applications without requiring extensive knowledge of data science or machine learning.

Language comprehension, computer vision, speech to text, text to speech, and translator text are a few of the capabilities provided. With the aid of straightforward REST APIs, SDKs, and client libraries, developers can quickly include these APIs into their applications. Businesses can create more intelligent and interesting applications that can recognize, evaluate, and react to regular human interactions by utilizing Azure Cognitive Services.

6. Increase Advancement of MS Azure Security

Microsoft Azure has made important security improvements to offer clients a safe cloud platform. Azure Future in Security Centre, which offers unified security management and threat protection across hybrid cloud workloads, is one of the more recent security capabilities.

A cloud-native SIEM and SOAR solution called Azure Sentinel aids in the identification, analysis, and reaction to security threats. To assist clients in fulfilling their security and compliance obligations, Azure additionally provides data encryption, network security, and compliance certifications.

Expect More Microsoft Price Increases in 2024

As we anticipate further Microsoft price hikes in 2024, effectively managing Microsoft software spend remains a top priority for enterprise vendor management leaders.

U.S. Public Sector

Microsoft 365 price increases will impact the public sector beginning in March 2024, with an increase of 10% for Office 365 G1. In March 2025 prices will increase yet again by 5%. For those public sector organizations with major contract renewals due in 2024 and 2025, these increases may amount to millions of dollars.

To address public scrutiny on government spending, agencies must prioritize value for taxpayers’ money through initiatives like software and cloud cost optimization.

India

Microsoft customers in India will see a 7% price increase in both its commercial on-premises software and online services effective February 1, 2024. This will be the third consecutive year of prices increases by Microsoft in India following a signicant option of Microsoft 365 and Dynamics 365 during the pandemic years of 2020-2021.

Asia

Japanese customers will see an increase of 20% for both commercial on-premises software and online services, effective April 1, 2024 – the highest rise in prices announced by the software giant.

Bills in South Korea, and Taiwan will rise on February 1, 2024. Korean customers will pay 8% more for cloudy services and 10% percent more for on-prem wares.

Taiwan was spared an on-prem increase, but users there will pay 7% more for cloud services. Chinese customers will get the same increase on May 1, 2024.

Third-Party Support - 2024 Microsoft Cost-Savings Opportunity

Software is the second-highest IT spend category, which drives sourcing, procurement, and vendor management leaders to analyze cost-saving opportunities from independent third-party support providers.

Use the Gartner market guide to reduce your Microsoft software support costs by 50% or more, resulting in millions of dollars in savings per year for enterprises worldwide.

Key Findings

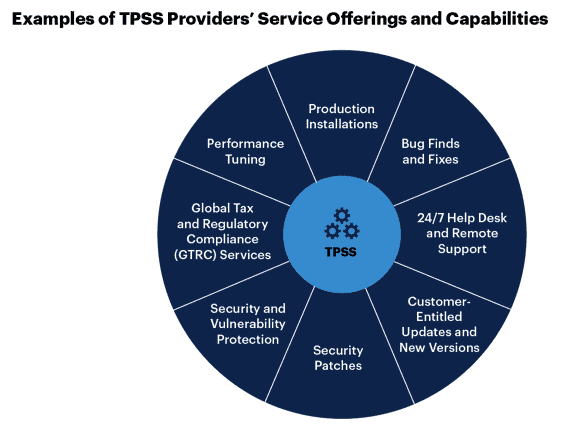

- Sourcing, procurement, and vendor management (SPVM) leaders who research and analyze all viable maintenance options for their Microsoft software are well positioned to recommend cost optimization alternatives to their stakeholders.

- Comparing third-party software support (TPSS) offerings and the support policies and contract term governing the Microsoft products minimizes the risk of selecting a third-party provider with lower prices but insufficient service offerings.

- A critical success prerequisite to engaging third-party software support (TPSS) is a thorough evaluation and comparison of the TPSS support offerings and contract terms with those governing the Microsoft products.

SPVM leaders reduce cost and operational risk when they engage stakeholders for a TPSS risk-benefit analysis and then arrange proof of concept (POC) engagements for the providers to showcase their service offerings and support capabilities.

Source: Market Guide for Independent Third-Party Software Support for Megavendors

27 November 2023 – Gartner ID G00778849 – 26 min read