Microsoft Licensing Solution Providers (LSP) Lose Enterprise Agreement (EA) Revenue.

- Microsoft Licensing Solution Providers (LSP) Lose EA Revenue

- Microsoft's Hostile Takeover of EAs from LSP Enterprise Software Advisors in 2024

- Fortune 500 / Global 2000 EA Value Ranges from $30M to $2B

- Microsoft LSP’s EA Revenue Loss Leaves Big Gap

- Why is Microsoft Removing LSPs from Commercial EA Deals?

- Microsoft LSPs Offset EA Losses with US Cloud Partnership

Microsoft Licensing Solution Providers (LSP) Lose EA Revenue

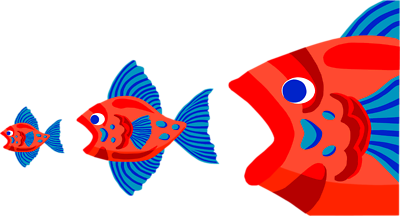

Microsoft LSPs are scrambling to replace Enterprise Agreement (EA) revenue as Microsoft takes over partner accounts. Announced January 1, 2023, the EA takeover announcement is now impacting LSP revenue streams as EAs come up for renewal and are lost to the Microsoft Direct Sales Team.

LSPs will lose a significant revenue stream from rebate/royalty/commissions (typically 1-1.5%) on each EA. LSPs may remain the partner of record status. Assuming 3-year EA terms, all large Microsoft Enterprise Agreement accounts will be lost to Microsoft Sales Direct by January 1, 2026. LSPs Enterprise Software Advisors must move swiftly to find alternative revenue streams to offset the EA loss.

Microsoft's Hostile Takeover of EAs from LSP Enterprise Software Advisors in 2024

Like many Microsoft Partner ecosystem announcements that are made quietly (and seemingly in a vacuum) and have significant long-term consequences yet near zero immediate pain, the EA Takeover is now coming home to roost.

As of January 1, 2024, Microsoft has now taken one-third of the large Enterprise Agreement renewals back from LSP partners. An additional 65% in EA commission revenue loss will be felt by the LSPs over the next 24 months.

Are the EA commission losses material to LSP financials and why is Microsoft making changes to the Enterprise Software Advisor (ESA) program and its Licensing Solution Provider (LSP) members?

Fortune 500 / Global 2000 EA Value Ranges from $30M to $2B

First, let’s take a look at the global large Microsoft Enterprise Agreement (EA) market to understand the revenue and commissions at stake. All numbers are conservative estimates extrapolated from Microsoft interviews and public domain financial information from 2018-2023.

There are 2,000 global Microsoft accounts worth $100M each for a 3-year term Microsoft Enterprise Agreement resulting in $200B EA revenue. 1.25% LSP commission percentage against the $200B in EA sales results in $2.5B commissions due to LSP partners that Microsoft will no longer pay out after 12/31/25.

Microsoft revenue in 2023 was $211B so taking back $2.5B (recognized over 3 years) in commissions from LSP partners will result in a .39% increase in EBITDA per year. Significant for a behemoth with a $3T market cap and 7% year-over-year targeted growth.

Microsoft LSP’s EA Revenue Loss Leaves Big Gap

There is no getting around the fact that a $2.5B loss in revenue over 3 years (2023-2025) will have a material impact on the Microsoft Licensing Provider Solution (LSP) community.

While the EA revenue accounts for less than a half point in EBITDA to Microsoft, LSPs may see up to 10x that loss in EBITDA relative to their entire licensing revenue, particularly those that haven’t diversified with other vendor licensing lines or invested in a professional services arm.

Licensing Solution Providers must act quickly in 2024 to wring more revenue from its existing Microsoft enterprise customer base or be forced to cut headcount and capabilities in 2025.

Why is Microsoft Removing LSPs from Commercial EA Deals?

There’s no simple answer to why Microsoft License Solution Providers (LSPs) are seemingly losing the right to sell Enterprise Agreements (EAs). It’s a complex issue with several contributing factors:

Shifting focus to direct sales: Microsoft has been increasingly focusing on direct sales for EAs, leveraging their own sales force and online platforms. This move aims to capture more control over customer relationships and increase profit margins.

Increased minimum requirements: In 2016, Microsoft raised the minimum user/device requirement for new commercial customers to purchase EAs from 250 to 500. This effectively excluded smaller LSPs from the market, as they may not have enough clients to meet the threshold.

Evolving EA structure: EAs have become more complex, encompassing various cloud services and subscription licenses. This shift requires a deeper understanding of Microsoft’s offerings and potentially higher technical expertise, which some LSPs may not possess.

Rise of cloud marketplaces: Alternative platforms like Azure Marketplace offer direct access to Microsoft cloud services, potentially bypassing LSPs. This can be attractive to customers seeking simpler procurement processes.

Focus on profitability: Microsoft might be prioritizing partnerships with LSPs who demonstrate higher profitability and contribute significantly to their overall sales. This could lead to consolidation within the LSP market, with smaller players struggling to compete.

Public sector: Public sector LSP EA sales are unaffected and Commercial LSPs can still participate as sub-contractors or referral partners.

Here are some additional points to consider:

- The impact of these changes may vary depending on the region and industry.

- Some LSPs may specialize in smaller deals or niche offerings, carving out a space for themselves despite the challenges.

- The rise of managed service providers (MSPs) such as US Cloud could offer new opportunities for LSPs to partner and deliver value-added services around Microsoft support services.

Microsoft LSPs Offset EA Losses with US Cloud Partnership

In January 2024, a prominent US Microsoft LSP, already doing business with US Cloud, called and announced they wanted to “greatly expand the relationship” and strategically grow the partner revenue in 2024 and 2025 by reselling US Cloud Microsoft Support services to its entire enterprise customer base.

US Cloud can work closely with Microsoft LSP Enterprise Software Advisors to educate selling teams around US Cloud’s Support which effectively saves enterprises 30-50% on Microsoft Premier/Unified Support.

US Cloud encourages LSPs to diversify their offerings by increasing Microsoft professional service capabilities since the support savings can be used to fund strategic customer projects. In addition, we recommend that LSPs consider additional vendor licensing revenue streams to help cover the loss in Microsoft EA revenue.