Top 5 Hidden Dangers Lurking in Microsoft Unified Support Agreements.

- Hidden Dangers Lurking in Every Microsoft Unified Support Agreement

- Danger #1 - Multiyear MS Unified Agreements

- Danger #2 - Combining Unified with Microsoft Enterprise Agreements

- Danger #3 - Transparency in How MS Unified Enterprise Agreements are Priced

- Danger #4 - Predicting the Future Cost of Microsoft Unified Contracts

- Danger #5 - Quality of Microsoft Unified Support

Danger #1 - Multiyear MS Unified Agreements

While the idea of longer-term price certainty will be tempting, the cost of future years is not truly locked in.

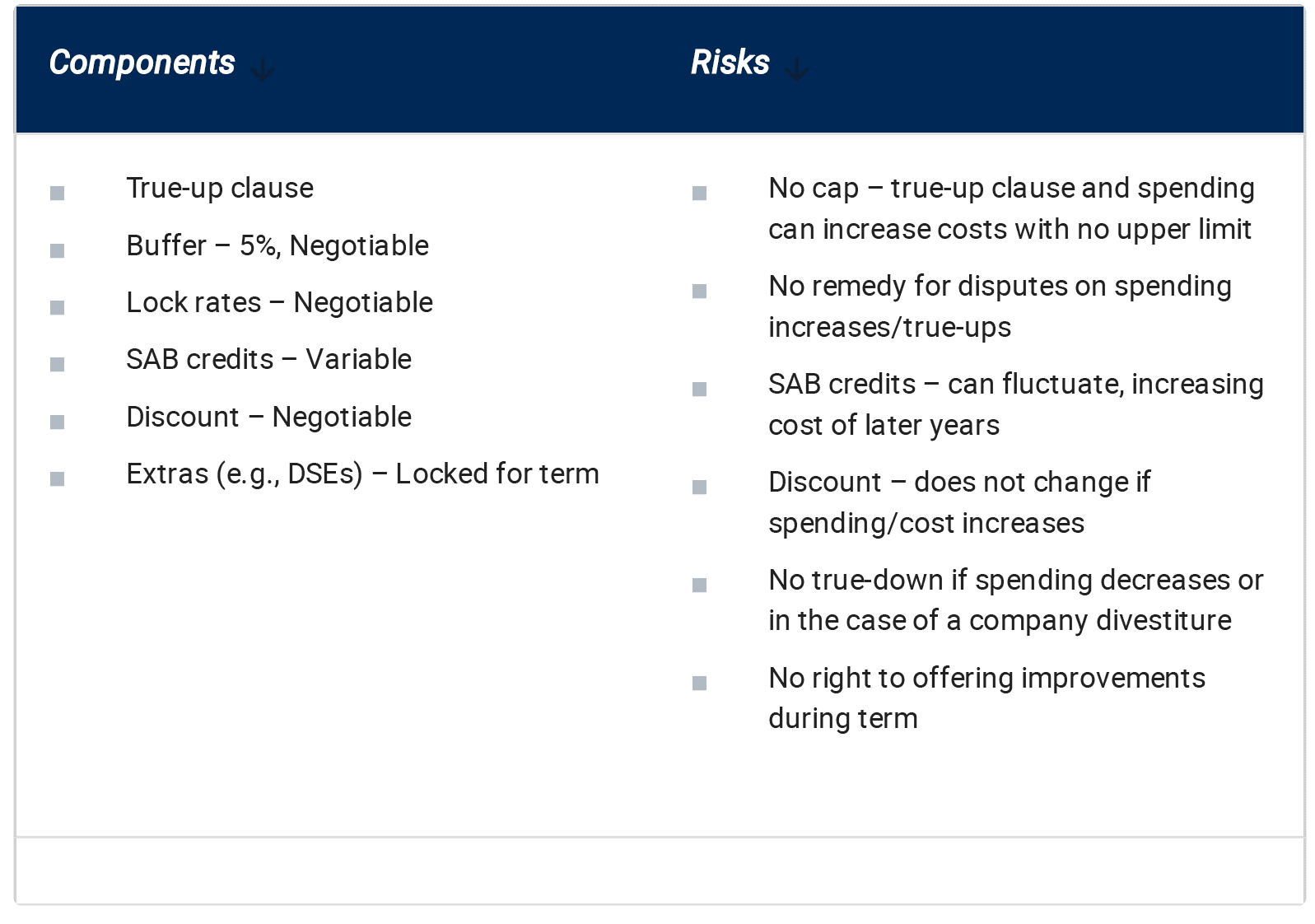

Microsoft is offering more enterprises multiyear Unified Support agreements. Procurement and Vendor Management leaders who need cost predictability from year to year may be tempted to sign a multiyear agreement. While the idea of longer-term price certainty will be tempting, the cost of future years is not truly locked in. 3 year Unified Support agreements have several characteristics that create additional risk:

A true-up clause: If the enterprise’s spending on Microsoft products and services increases from the estimated year’s spending by more than the “buffer rate” (usually 5%), the cost will be recalculated based on “lock rates” provided by Microsoft for future years.

No cap on increases: Microsoft’s standard Unified Support agreement terms include no cap on the price. So if Azure spending skyrockets, the organization must pay based on the higher spending with no flexibility to renegotiate the price, or else drop support.

No true-down clause: Conversely, if an organization decides to move services off Azure to an alternative public cloud provider, its support costs will not decrease during the term of the contract.

No divestiture clause: Unified Support contracts lack any provision to reduce the cost of future years in the event of a divestiture of part of the organization.

No beneficial changes: Organizations in multiyear agreements may not get the advantages of improvements that Microsoft makes to Unified Support or new service capability of third-party providers (LINK), during the term of the agreement.

Danger #2 - Combining Unified with Microsoft Enterprise Agreements

Negotiators and IT Procurement should plan accordingly and analyze Unified Support costs outside the Microsoft Enterprise Agreement (EA) to reduce their overall Microsoft spend and preserve their enterprise IT budget.

Bundling Equals Better Margins

Sales professionals know that bundling services together typically yields better profit margins. Microsoft is an expert at bundling services and increasing margins.Microsoft 365 licensing bundles for enterprises are a well-known example. On the other hand, Enterprise Agreements with Unified Support bundled together are less well-known but equally effective at driving support revenue at Microsoft.

By bundling Unified Support with the EA, Microsoft quietly picks up another 6-12% in margin and avoids scrutiny and analysis of Unified Support’s rapidly expanding costs. Microsoft astutely understands that EA negotiators and IT Procurement may not have the time or appetite to dive into their Unified Support bill or engage Gartner, IDC, or InfoTech for assistance.

As a percentage of the overall Microsoft Enterprise Agreement, Unified Support looks insignificant, but when converted to real dollars, it is meaningful. Negotiators and IT Procurement should plan accordingly and analyze Unified Support costs outside the EA to reduce their overall Microsoft spend and preserve their enterprise IT budget.

Lost Cost Avoidance Opportunity

Microsoft Enterprise Agreements are 3-year agreements. If you include Unified Support in your EA, you are locked into Microsoft for support for at least 3 years.This vendor lock-in may result in your enterprise’s inability to both avoid Unified support cost increases via annual true-up at Microsoft and take advantage of cost savings opportunities outside of Microsoft.

By adding Unified Support to your Microsoft EA, your organization may assume that its support costs will be contained. Unfortunately, this will not be the case if your cloud consumption is growing like most companies. Your enterprise’s support spend baseline will true-up once per year, most likely establishing a new and higher cost baseline for Microsoft support.

If IT Procurement or your EA negotiator bundles Unified Support with the Enterprise Agreement you will not be able to explore alternatives to Microsoft for at least 3 years. Analysts report 30-50% cost savings is possible with third-party Microsoft support. Gartner, IDC, and InfoTech and have each identified viable alternatives to Microsoft Unified Support. Organizations moving away from Microsoft earlier are able use their savings strategically to grow while others are shackled to their Microsoft EA.

Danger #3 - Transparency in How MS Unified Enterprise Agreements are Priced

Enterprises want transparency from Microsoft in how their Unified Support cost is calculated. While Premier Support is now only available to government and education organizations, its per hour model was simple and transparent.

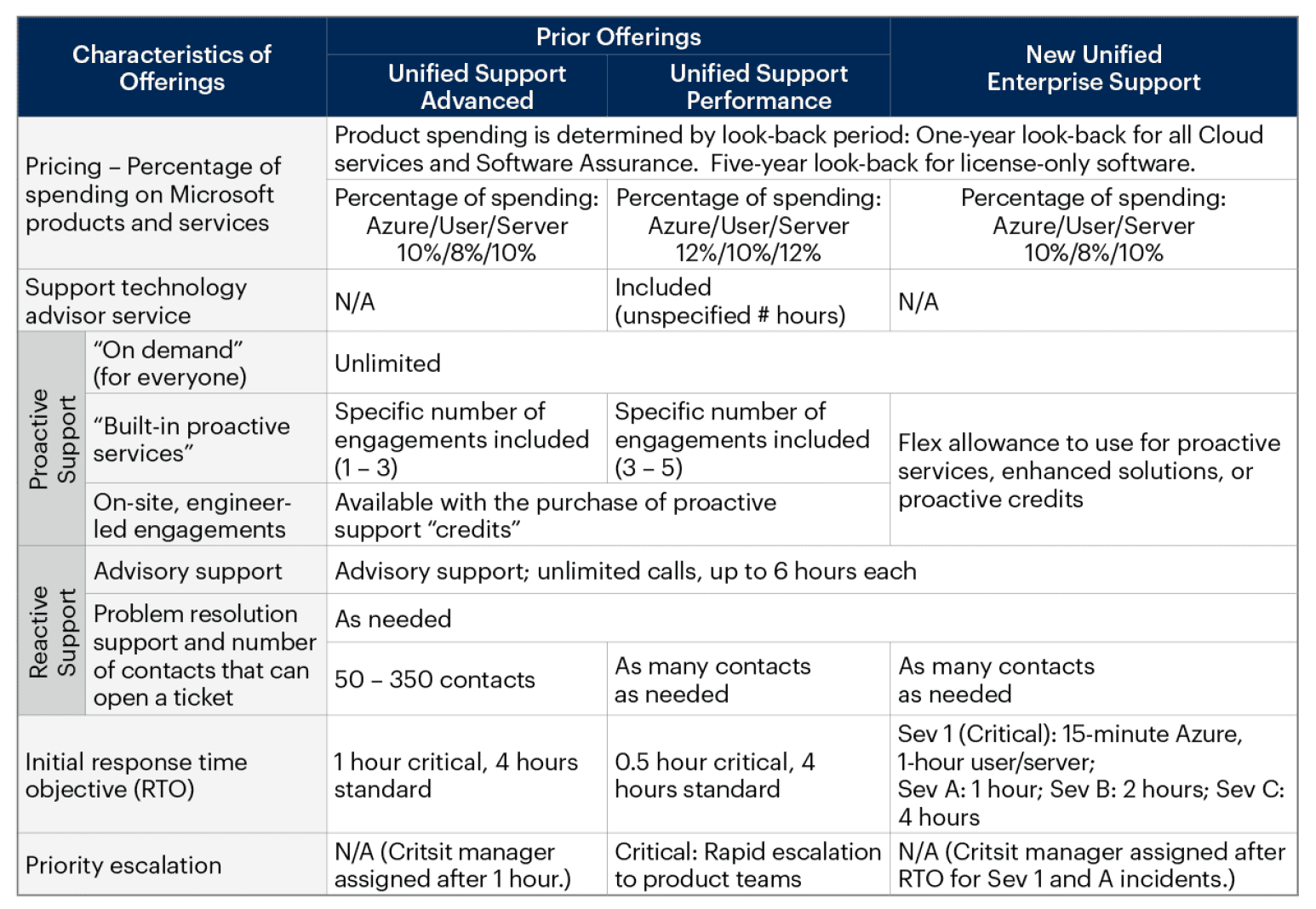

Microsoft made the following two important announcements about its support offerings in mid-2021, but for most organizations negotiating Unified Support, transparency, predictability and quality still require the most attention.

The announcements were:

Microsoft Premier support is retired on June 30, 2022.

Unified Core, Advanced and Performance plans are being replaced by Unified Enterprise on June 30, 2022.

Transparency in how Unified Support is priced, is much clearer in Unified Enterprise. However, full details behind product and service licensing are often missing from proposals. Professional Microsoft negotiators and IT analysts suggest:

Request a Unified Enterprise Support proposal if you are being offered legacy Unified Advanced or Performance support, and always request that proposals include full detail of cost calculations, including product and service details for all licensing agreements.

Request that your Unified Support costs only be based on annual payments for online services and Software Assurance (SA), excluding license and true-up costs, to optimize your price.

Danger #4 - Predicting the Future Cost of Microsoft Unified Contracts

Organizations need Microsoft Unified Support pricing to be predictable from year to year so they can budget appropriately and avoid cost increase surprises.

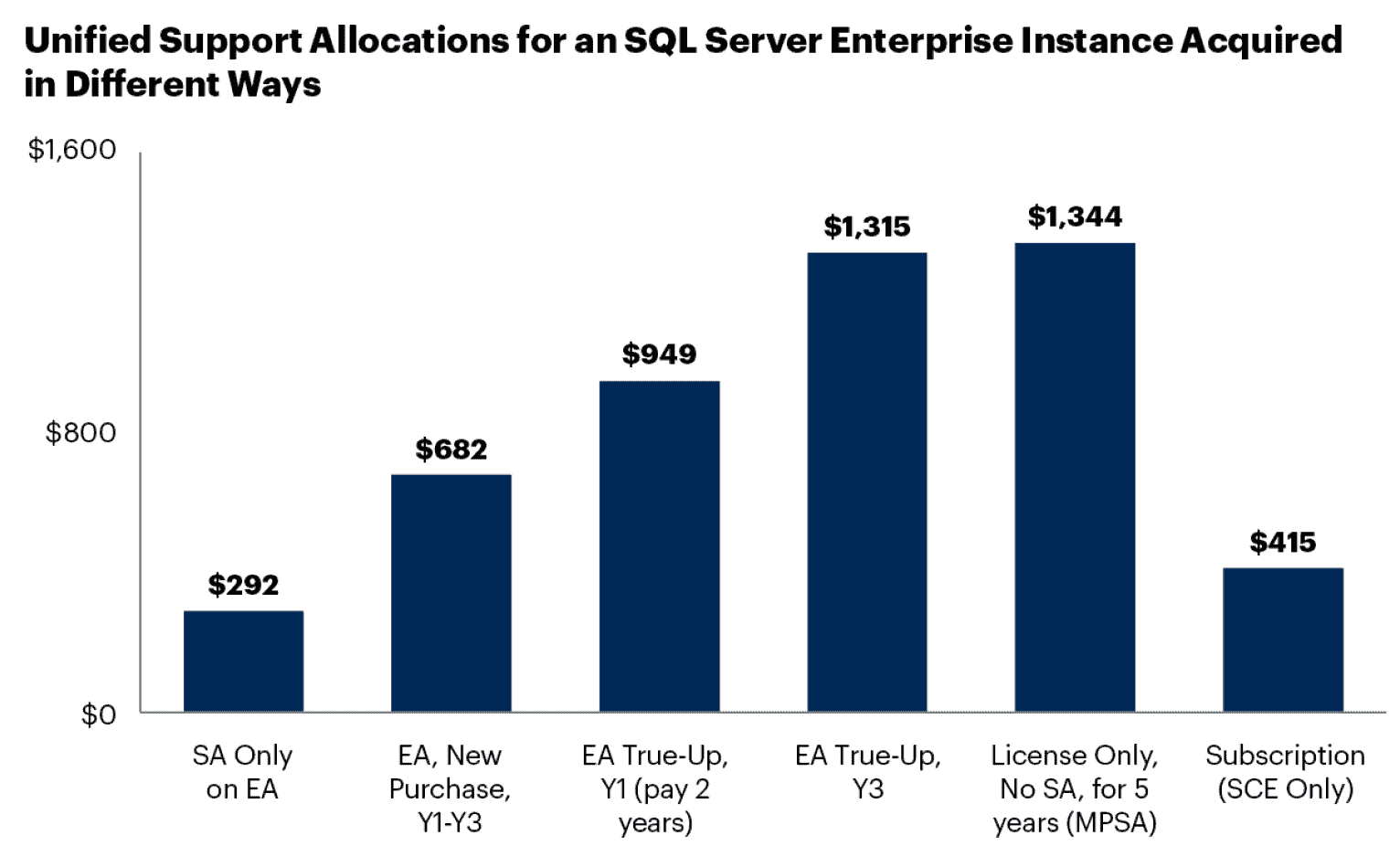

Enterprises using Microsoft software and cloud services often purchase Microsoft’s additional support offering, Unified Support. Negotiating predictable Unified Support agreements can be challenging for Procurement and Vendor Management leaders because the offering covers the complete range of software and cloud services purchased over the prior five years.

Organizations need Microsoft Unified Support pricing to be predictable from year to year so they can budget appropriately and avoid cost increase surprises. For most enterprises, MS Unified Support future pricing remains inconsistent due to their own increasing cloud consumption and Microsoft’s pitfall-laden multiyear agreements.

As a result, many enterprises seeking advice from IT analyst groups like Gartner, IDC, Forrester, Directions on Microsoft, and Info-Tech, are being advised to explore viable third-party alternatives to Microsoft. With savings up to 65%, proof of concepts, and effective multi-year options, third-party support for Microsoft is worth exploration.

Danger #5 - Quality of Microsoft Unified Support

Enterprises pay a premium for direct support from Microsoft but find the quality to be disappointing time and again.

The last and biggest risk lurking in Microsoft Unified Support agreements is quality of support. Enterprises pay a premium for direct support from Microsoft but find the quality to be disappointing time and again.

Here’s a brief list of Unified support quality shortcomings:

No Service Level Agreements (SLA). You now receive Response Time Objectives (RTO) but there is nothing in the Unified agreement if Microsoft fails to meet their published RTO by severity. Industry stand for third-party support providers is financially backed SLAs.

No Technical Account Managers (TAM). TAMs have been retired and replaced with Customer Success Account Managers (CSAM). TAMs were highly technical advocates for enterprises. IT leaders often mention that the TAM was their most important asset of Microsoft Premier support.

Offshored support. Microsoft is unable to guarantee that a foreign individual will not handle your support tickets and logs because much of Unified is outsourced overseas. This creates obvious support sovereignty issues for government or regulated industries as well as practical communications barriers resulting in IT team wasted time and frustration.

Low severity tickets. With the new “unlimited” ticket model of Unified, Microsoft is not able to keep up with demand. It is forced to focus on high severity support tickets and let low priority tickets languish for weeks and months. While not impacting uptime of critical systems, low severity issues often impact end users and customer experience.

Time to Resolution (TTR). Microsoft TTR is increasing. As ticket loads increase at Microsoft the highly-siloed support model is failing. Most enterprises are now operating a hybrid Microsoft architecture where it is rare for a Microsoft support ticket to only impact one technology or not involve both cloud and on-premise assets.